Annual Report

DMV – LOTTERY – MARIJUANA – SPECIALIZED BUSINESS GROUP – TAXATION

Mission

To become a trusted partner to every Coloradan to help them navigate the complexities of government so they can thrive

Vision

Empowering, Enhancing, and Enriching life in Colorado

& – – @ # % +

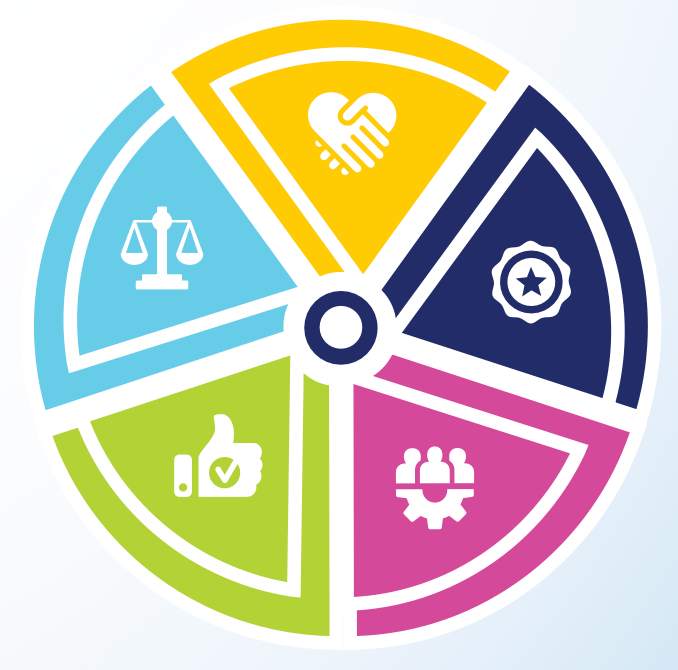

Values

S: Service

We are dedicated to helping the residents and visitors of our state and our fellow employees to thrive.

T: Teamwork

We work collaboratively with one another toward a common goal, breaking down silos, and building mutual trust.

A: Accountability

We are responsible stewards of public resources, follow through on our individual and shared commitments, and move past setbacks to achieve growth.

I: Integrity

We do the right thing, acting with honesty, transparency, and strong ethical principles.

R: Respect

We communicate, listen, and act with high regard for others, sharing information in a constructive manner, and treating others with dignity and grace.

Message From the Executive Director

Heidi Humphreys

To the People of Colorado,

Here at the Department of Revenue (DOR) we know that for many Coloradans, we are the only interaction they regularly have with their state government.

The Department strives to make that experience positive and easy. Whether it is the ability to renew your driver license without coming into an office, new ways for small businesses to remit sales taxes or getting a license to start a business, we are constantly looking to improve that experience. The Department both understands and is humbled by the impact we have on the lives of Coloradans. It is our goal to earn and maintain the trust of the public we serve through great customer service and continued innovation.

At the heart of our agency is our shared core values of Service, Accountability, Teamwork, Integrity, and Respect. Those values are in everything we do and shape how we approach our varied jobs in the 10 Divisions that make up the Department of Revenue.

Over the past year, our efforts have helped improve the lives of Coloradans in many ways, including:

The Division of Motor Vehicles (DMV) prioritized customer service making it possible to take the written driving test online with their new @Home Testing service, removing the need to come into an office.

The Colorado Lottery, for the third consecutive year, posted record-breaking sales of more than $890 million, with record distributions of $195 million. Proceeds from the Lottery support the places Coloradans love to play. Lottery dollars help fund parks, trails, open space, and wildlife conservation, as well as school capital construction projects.

The Marijuana Enforcement Division (MED) launched an underage sales compliance dashboard to provide better transparency in their efforts to keep Marijuana out of the hands of minors.

The Specialized Business Group’s (SBG) Liquor Enforcement Division had the large task of overseeing the implementation and compliance of Proposition 125, as passed by Colorado residents on Nov. 8, 2022, that allowed wine to be sold in new places like grocery stores in Colorado. The SBG’s Gaming Division, now in its third year of Sports Betting operations, posted record numbers in a year that saw the Denver Nuggets become NBA Champions. The tax revenue from sports betting goes towards the Colorado Water Plan, which ensures the people of Colorado will have plenty of water for years to come.

The Taxation Division was called upon to expedite TABOR refunds during a time of record inflation to get checks in the hands of Coloradans through the Colorado Cash back program.

The Department was tasked by statute to establish the Natural Medicine Division. An entirely new Division that will be responsible for regulating and licensing the cultivation, manufacturing, distribution, testing, storing, transportation, transfer and dispensation of natural medicines, and regulated natural medicine products in Colorado in partnership with the Department of Regulatory Agencies (DORA).

These are just a few amazing achievements that DOR accomplished this past fiscal year and this report highlights many more. I am extremely proud of the great employees that make this Department run smoothly for the benefit of Colorado and the great people who call this state home, and it is my honor to serve as their ExecutiveDirector.

Sincerely,

Heidi Humphreys Executive Director

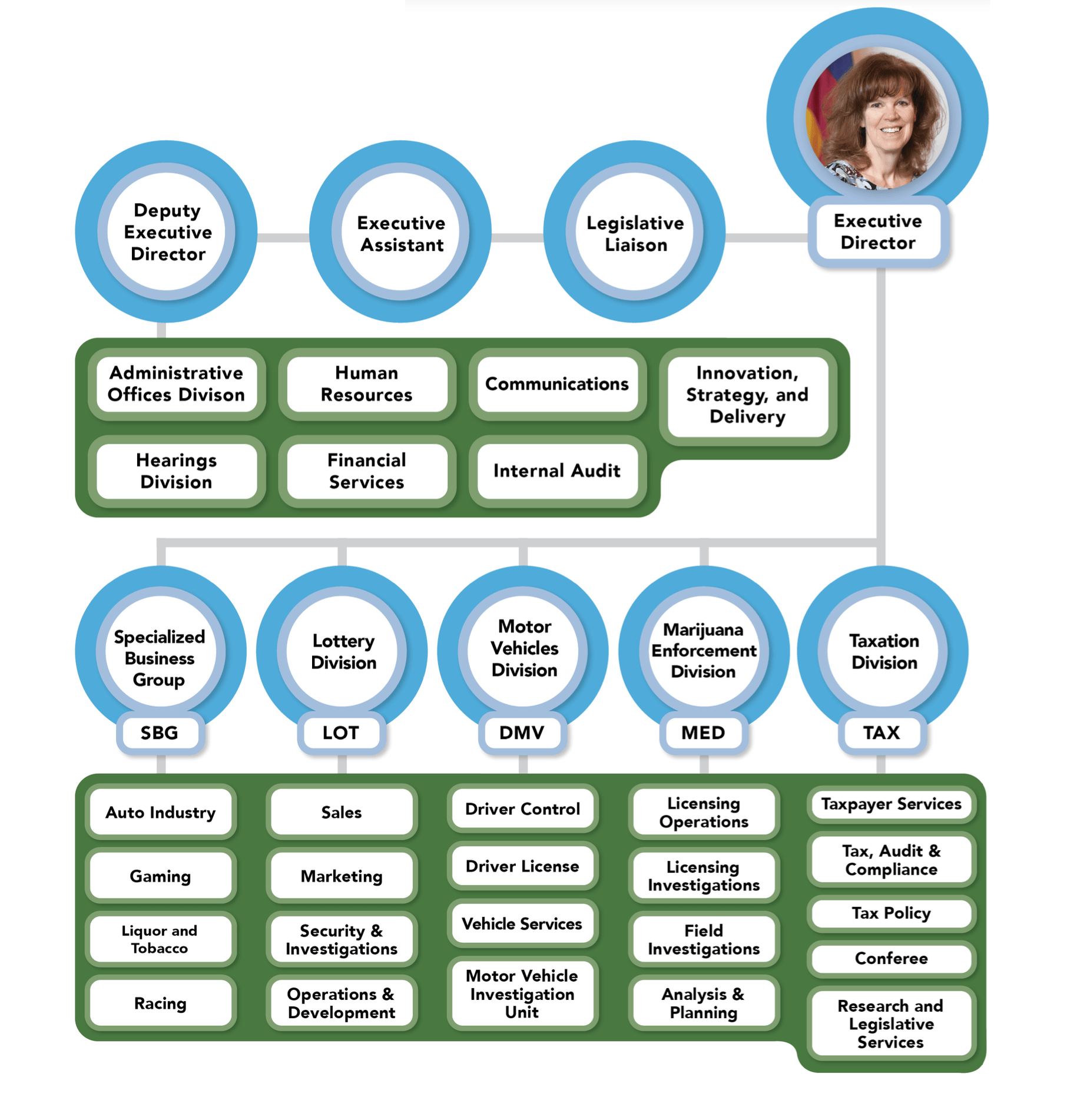

Organizational Chart 2023

Executive Director’s Office

The Executive Director’s Office (EDO) is committed to fulfilling the Colorado Department of Revenue’s (DOR) mission and vision by living our values every day. The EDO is made up of the Administrative Offices Division (AOD), Financial Services (FS), the Legislative Liaison, the Office of Communications, Internal Audit, Innovation, Strategy and Delivery (ISD), and the Hearings Division. Each section under EDO supports the divisions in delivering efficient, effective and quality services for the people of Colorado.

Administrative Offices Division

The Administrative Offices Division (AOD) serves as DOR’s central operational support office by providing exemplary service to internal and external customers. It consists of the offices of the Office of Communications, Facilities, Safety and Security, Records Management, Forms and Graphics Development, the Hearings Division, and Mail Services.

Marijuana Enforcement Division

Guiding objectives for the Marijuana Enforcement Division (MED)’s success during FY 2022-2023

Guiding objectives for the Marijuana Enforcement Division (MED)’s success during FY 22-23 included meeting milestone metrics, implementing key legislation and improving the technology solutions to manage the Divison’s needs. Supporting these efforts, the Division made significant improvements that streamlined the MED website and improved the MED Data Dashboard, launched an underage sales compliance dashboard, and proactively posted Final Agency Actions to increase transparency.

The MED staff worked hard to represent the DOR values of service, teamwork, accountability, integrity, and respect by protecting the public health and safety of the people of Colorado through responsible regulation of the state’s legal marijuana industry.

The MED regulates and licenses the cultivation, manufacturing, testing, distribution, and sale of medical and retail marijuana in Colorado. The mission of the MED is to promote public safety and reduce public harm by regulating the Colorado commercial marijuana industry through the consistent administration of laws and regulations and strategic integration of process management, functional expertise, and innovative problem-solving.

Wildly Important Goals (WIGs)

The MED uses WIGs to measure DOR’s progress toward goals that advance our mission. The MED leads the effort for several Cannabis Cabinet WIGs. The MED helped Regulated Marijuana Businesses (RMB) designated as Social Equity Licensees (SEL) become operational. The Division determined that 45.10% of SEL who had been licensed for at least 60 days demonstrating business operations or transactions were operational by June 30, 2023, just shy of the ambitious goal of 50%, a significant improvement from 8.33% at the end of Q1.

Four lead measures helped the MED make significant progress toward our social equity WIG goal. The MED hosted two networking and resource fairs geared towards social equity applicants and licensees in collaboration with other state and local agencies in FY 22-23 and developed and hosted two technical assistance clinics for social equity applicants and licensees in FY 22-23, hitting our goals.

The MED staff created over 10 compliance tools on topics to assist prospective and current social equity licensees throughout the life cycle of hosting a business license in FY 22-23, well above our goal of four. Lastly, the MED launched a quarterly newsletter (the MED’s In the Weeds) with a dedicated section to support social equity licensees, sending four quarterly newsletters in FY 22-23 and plans to continue the newsletter next fiscal year.

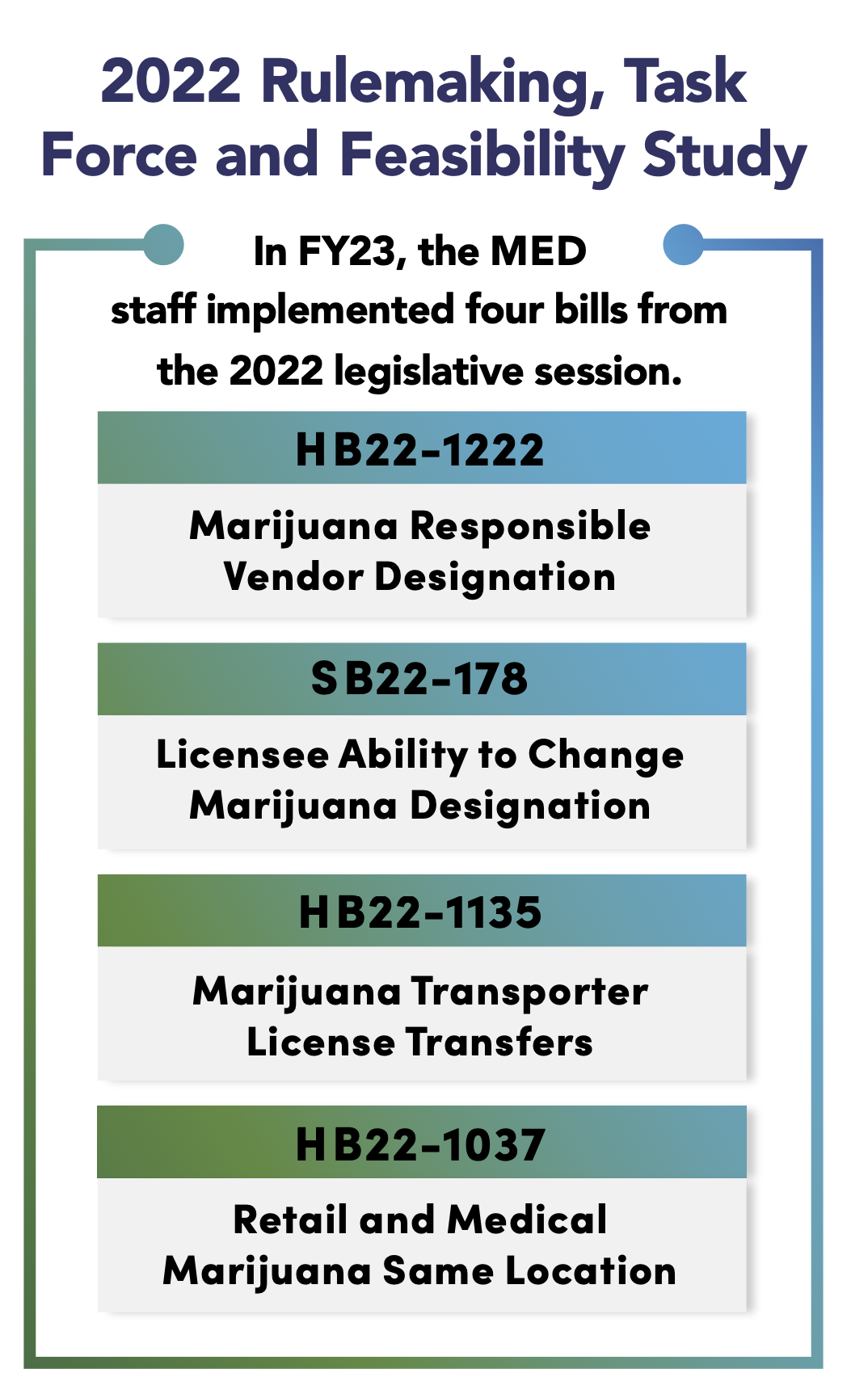

2022 Rulemaking, Task Force and Feasibility Study

In addition to legislative implementation rulemaking sessions conducted in FY 22-23, the MED once again hosted sessions focused on Science and Policy Work Group priorities and catch-all items. The MED Senior Director Dominique Mendiola sat on the SB 22-205 Task Force (Intoxicating Hemp And Tetrahydrocannabinol Products). After over 20 meetings, the Task Force submitted a Final Report to the General Assembly, with the state agencies involved in issuing a Supplement, providing a set of purposeful recommendations regarding the sale of hemp-derived products.

Additionally, pursuant to SB 22-120 Regulation of Kratom Processors, division staff convened a group of interested parties to put together a feasibility study on kratom following legislative directives to develop a report containing recommendations for regulating kratom products. Staff from the Department’s Liquor Enforcement Division assisted throughout the process along with key stakeholder groups.

The MED is a nationally recognized leader in cannabis regulation

In June 2023, the MED Senior Director Mendiola was elected to serve as President-elect for the National Cannabis Regulators Association (CANNRA) where she has served as a board member at large since June 2022.

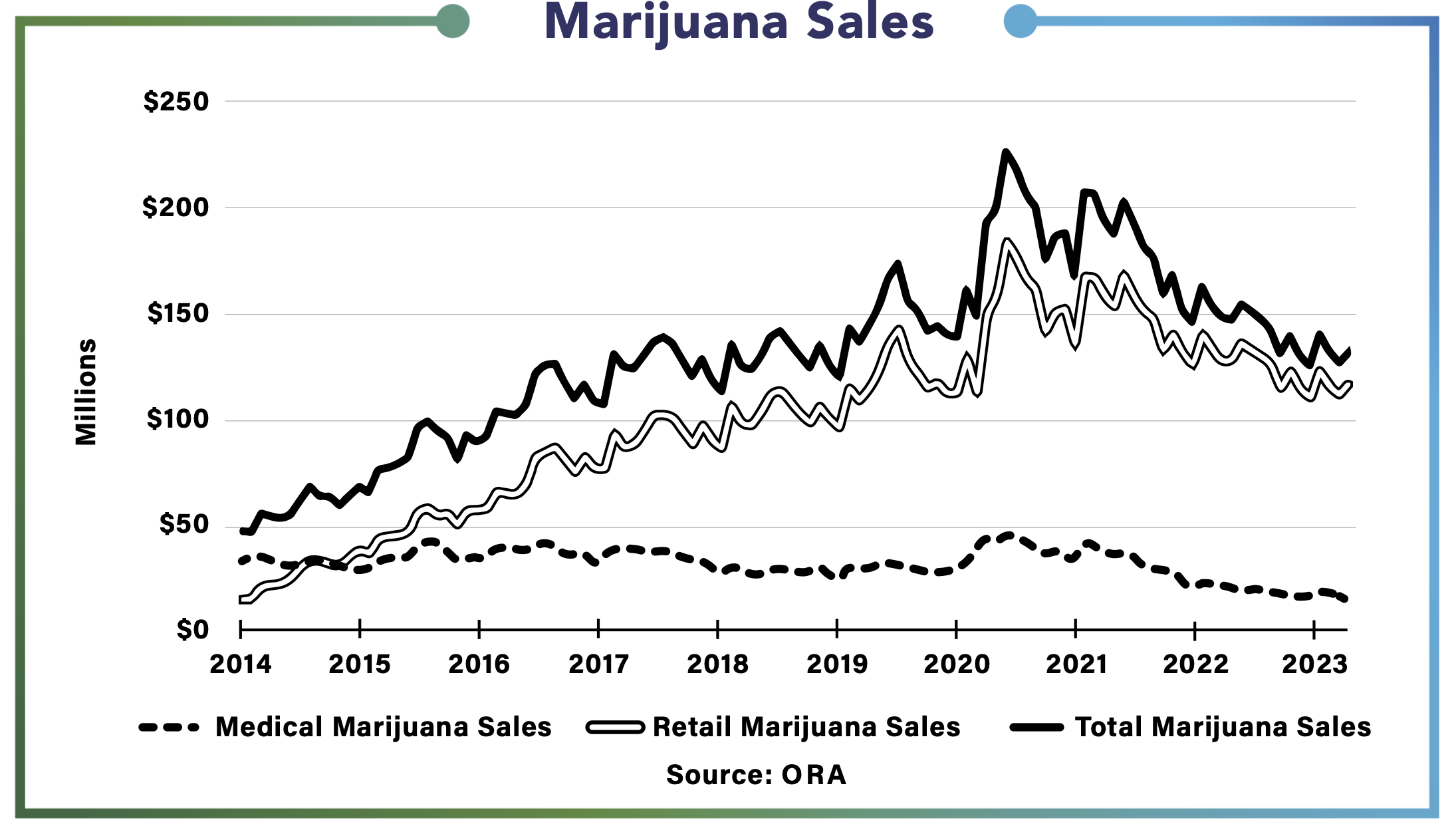

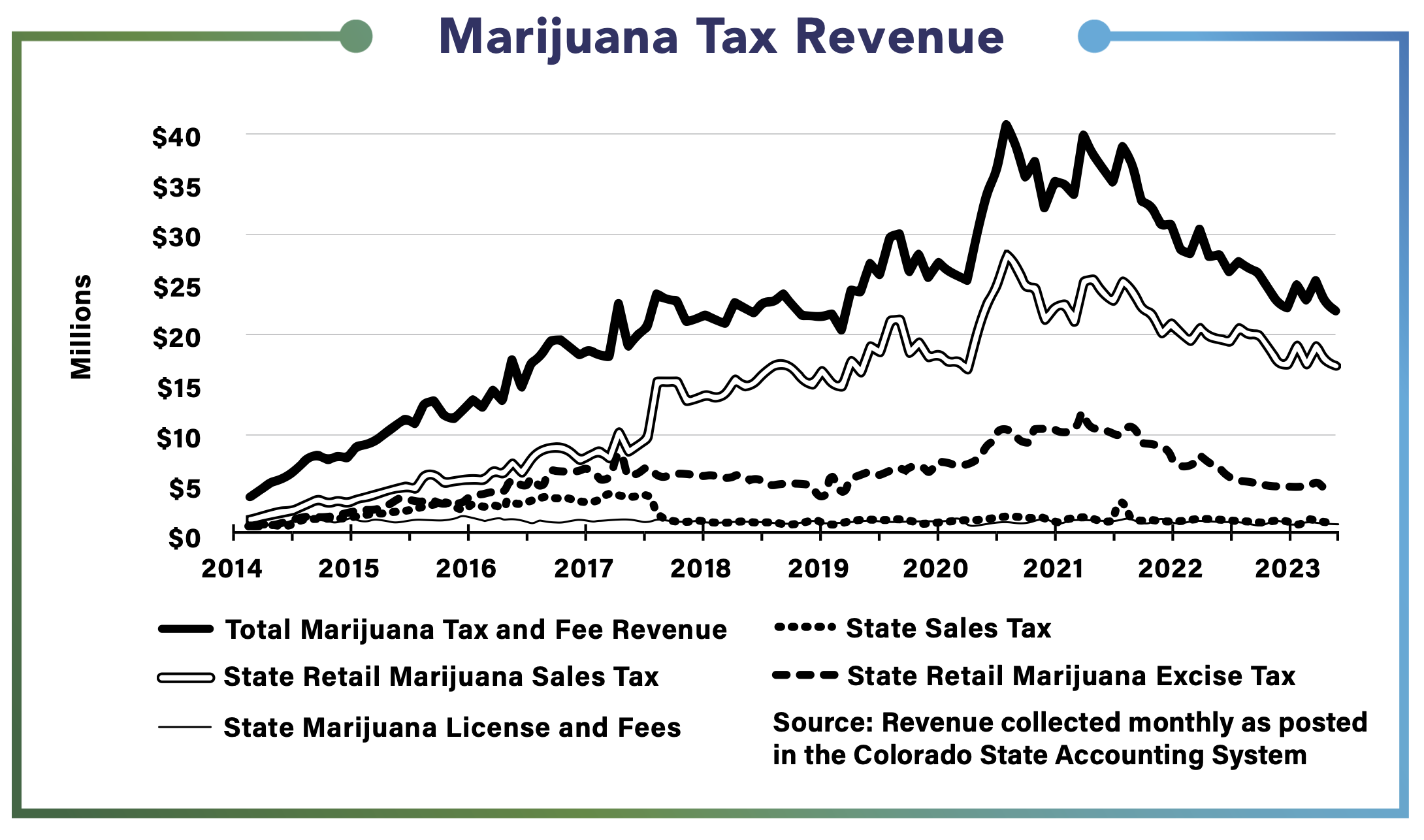

Tax Revenue and Sales Numbers

During FY 22-23, marijuana sales saw a notable reduction throughout the state, impacting the state revenue generated through marijuana excise and sales taxes.

Specialized Business Group

Liquor & Tobacco Enforcement Division

The leading theme for the Liquor and Tobacco Enforcement Division (LED) during FY 22-23 revolved around reviewing and revising rules, regulations, and processes with stakeholders and industry members and educating those impacted by the changes.

The Division worked closely with multiple stakeholders throughout the fiscal year by conducting 77 liquor law and regulation trainings. The Division received 400 complaints involving the regulation of liquor and nicotine products, which resulted in investigations; 262 were unfounded, 63 licensees received a written warning, 40 were exceptionally cleared, 66 resulted in an administrative action, seven were transferred to local licensing authority action, 11 resulted in the issuance of a summons, and six are still in active investigation posture.

The Liquor Advisory Group and Legislative Changes

During FY 22-23, the Liquor and Tobacco Enforcement Division (LED) worked towards legislative implementation, stakeholder engagement and rulemaking, and facilitation of the Liquor Advisory Group (LAG) established pursuant to a letter issued to the Department’s Executive Director by Governor Jared Polis.

LED implemented two significant legislative changes during FY 22-23. SB23-264 – Alcohol Beverage Festival Participation – was implemented, which changed certain aspects of the festival permit and festival permit application process, including increasing the application timeline for each festival permit, increasing the processing fee due with each application, and allowing an eligible licensee to participate in up to 52 festivals in a calendar year.

HB 23-1061- Alcohol Beverage Retail Establishment Permit

Which expanded and renamed the art gallery permit to the retail establishment permit and allowed eligible permittees to serve complimentary alcohol beverages to patrons 24 days per calendar year for four hours each day, effective Aug. 2023.

Training and Regulation of the Alcohol Industry

The Division worked closely with multiple stakeholders throughout the fiscal year by conducting 77 liquor law and regulation trainings. The Division received 400 complaints involving the regulation of liquor and nicotine products, which resulted in investigations; 262 were unfounded, 63 licensees received a written warning, 40 were exceptionally cleared, 66 resulted in an administrative action, seven were transferred to local licensing authority action, 11 resulted in the issuance of a summons, and six are still in active investigation posture.

Tobacco Regulation

The Division also regulates tobacco/nicotine retailers within the state. The Division issued 1,865 new tobacco retail licenses and 57 permits in the fiscal year. The Division conducted 851 tobacco inspections, 12,781 tobacco compliance checks and issued 403 administrative actions. This year, the division engaged in stakeholder engagement and updated or implemented changes to the following tobacco regulations: 7-200 Petitions for Statements of Position and Declaratory Orders, 7-601 Penalties, and 7-900 Identification.

LegislativeImpactsonthe Gaming Industry

Working in collaboration with the gaming industry, Colorado legislators and stakeholders,theDivisionofGaming implemented several new legislative changes impacting the gaming and sports betting industries. FY 22-23 saw the second-year results from implementing Amendment 77, which removed betting limitsandintroducednewgames: Baccarat, Pai Gow, Casino Wat, Big Six Wheel, and Keno.

Responsible Gaming Initiatives Supported through Grant Funding

With the passage of HB22-1402, the Division of Gaming launched the Problem Gaming Grants Program to distribute funding to state agencies and non-profit organizations addressing problem gaming in Colorado. In the spring of 2023, the Commission approved two rounds of grants to different responsible gaming organizations, totaling $2,480,054.

Sports Betting Continues to See Record Growth

The third year of legalized sports betting in Colorado resulted in record returns in Annual Gross Product (AGP), taxes, and total distributions from the limited gaming and sports betting funds. At the Aug. 2022 meeting of the Colorado Limited Gaming Control Commission (CLGCC), commissioners approved the FY 22-23 distributions from the limited and extended gaming funds totaling $155,417,927.61, a 4.54% increase over the FY 22-23 distributions.

Auto Industry Division

Reducing fees, improving the process for license applications, and ensuring compliance with auto industry regulations and laws were the focus of the Auto Industry Division (AID) during FY 22-23.

Improving the Application Process

Improving and streamlining the process for licensees to submit their license applications has been a focused priority of the AID for many years.

Compliance with Rules and Regulations

The Division continues to work with stakeholders and the Motor Vehicle Dealer Board to ensure education, compliance, and enforcement of applicable laws.

In FY 22-23, the Auto Industry Division completed 857 investigations, an increase of 117%. These investigations resulted in 496 violations/ founded complaints.

Recognized Leadership

Notably, on June 14, the Division Director, Chris Rouze was awarded the Lance D. Thomas Award at the National Odometer and Title Fraud Enforcement Association. The award recognizes members for noteworthy achievements in consumer protection, odometer, and title fraud cases.

Compliance with Rules and Regulations

The Division continues to work with stakeholders and the Motor Vehicle Dealer Board to ensure education, compliance, and enforcement of applicable laws.

In FY 22-23, the Auto Industry Division completed 857 investigations, an increase of 117%. These investigations resulted in 496 violations/ founded complaints.

Utilizing an online application system, in FY 22-23, AID expanded the ability to apply for all 53 licenses online, which resulted in receiving 3,313 applications online during the fiscal year, an increase of 289%.

Division of Racing Events

During the 2022 live racing season, the Division of Racing Events worked on maintaining regulation and oversight of the horse racing industry in Colorado while balancing the new federal-level rules and regulations to improve safety and integrity in the racing industry across the United States.

| Motor Vehicle Case Types & Counts | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Excessive Points | 8,421 | 4,282 | 5,857 | 5,220 | 5,154 |

| Express Consent | 8,399 | 8,547 | 5,555 | 6,767 | 6,304 |

| Driver License Compact | 359 | 324 | 222 | 94 | 67 |

| DUI Convictions | 50 | 22 | 75 | 155 | 136 |

| Habitual Traffic Offender | 137 | 136 | 132 | 125 | 127 |

2023 Legislative Digest

The following is a high-level list of new laws enacted during the second regular legislative session of the 74th Colorado General Assembly that pertain to the Colorado Department of Revenue (CDOR). The effective dates are listed after each summary. Please visit the General Assembly website for more information on these acts at http://leg.colorado.gov/.

CDOR Bills

H B 23-1045: Employee Leave for Colorado National Guard Service (C D O R)

The bill clarifies that members of the CO National Guard and the United States Reserve Forces are entitled to three weeks of leave from their employers when called to service or training.

Effective 3/10/23

H B 23-1049: Enactment of CRS 2022 (C D O R)

The bill enacts the 2022 Colorado Revised Statutes, including laws adopted during the second regular session of the 73rd General Assembly, as the positive and statutory laws of the state.

Effective: 2/24/23

H B 23-1057: Amenities for all Genders in Public Buildings (C D O R)

The bill creates requirements for public buildings regarding non-gendered bathrooms, baby diaper changing stations, and signage.

Effective: 1/1/24

H B 23-1126: Consumer Reports Not Include Medical Debt Information (C D O R)

The bill modifies the prohibition on consumer reports to include medical debt and places disclosure requirements on debt collectors and collection agencies. DOR is required to conduct a study to examine the impact on customers.

Effective: 8/7/23 / Report by 1/1/28

H B 2 3 – 1 2 7 1 : L u n a r N e w Y e a r ‘ s D a y a s a n Observed State Holiday (C D O R)

The bill designates Lunar New Year Day as an observed but not a legal state holiday.

Effective: 6/7/23

H B 2 3 – 1 3 0 1 : R e v i s o r ’ s B i l l ( C D O R )

The bill amends or repeals obsolete, unclear or conflicting laws.

Effective: 8/7/23

| County | Registration Fees County | State Portion of Registration Fees | Fleet Registration Fees | Ownership Tax Full SOT by County | State portion of 0.50 for each SOT amount collected by county | County Prior SOT | State portion of 0.50 for each prior SOT amount collected by county |

|---|---|---|---|---|---|---|---|

| Adams | $5,442,000 | $193,303 | $2,210,676.06 | $193,303 | $193,303 | $5,433.54 | $193,303 |

| Alamosa | $193,303 | $5,442,000 | $776,069.28 | $193,303 | $193,303 | $1,442,000,233 | $1,442,000,233 |

| Arapahoe | $193,303 | $193,303 | $776,069.28 | $776,069.28 | $5,433.54 | $5,433.54 | $776,069.28 |

| Archuleta | $125,813.79 | $5,442,000 | $776,069.28 | $776,069.28 | $5,433.54 | $5,433.54 | $193,303 |

| Baca | $125,813.79 | $125,813.79 | $125,813.79 | $776,069.28 | $2,210,676.06 | $5,442,000 | $776,069.28 |

| Bent | $17,663 | $2,210,676.06 | $285,036 | $776,069.28 | $125,813.79 | $125,813.79 | $125,813.79 |

| Boulder | $6,225,932.14 | $285,036 | $17,663 | $776,069.28 | $285,036 | $285,036 | $1,442,000,233 |

| Broomfield | $6,225,932.14 | $6,225,932.14 | $5,442,000 | $6,225,932.14 | $17,663 | $6,225,932.14 | $17,663 |

| Chaffee | $285,036 | $6,225,932.14 | $6,225,932.14 | $285,036 | $125,813.79 | $6,225,932.14 | $6,225,932.14 |

| Cheyenne | $2,210,676.06 | $6,225,932.14 | $2,210,676.06 | $6,225,932.14 | $5,442,000 | $6,225,932.14 | $1,442,000,233 |

| Clear Creek | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 |

| Conejos | $17,663 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 | $6,225,932.14 |

| Costilla | $2,210,676.06 | $6,225,932.14 | $2,210,676.06 | $6,225,932.14 | $6,225,932.14 | $1,442,000,233 | $6,225,932.14 |

| Crowley | $2,210,676.06 | $6,225,932.14 | $2,210,676.06 | $6,225,932.14 | $2,210,676.06 | $6,225,932.14 | $6,225,932.14 |

| Custer | $2,210,676.06 | $2,210,676.06 | $6,225,932.14 | $6,225,932.14 | $17,663 | $1,442,000,233 | $17,663 |